In Dallas and Frisco, two of the most popular markets for flexible offices in Texas, rates for workstations and demand are down compared to 2021 numbers. However, demand remains high compared to pre-pandemic years in both markets. Central business districts are still seeing declines while suburban markets are maintaining strong demand.

In Dallas and Frisco, two of the most popular markets for flexible offices in Texas, rates for workstations and demand are down compared to 2021 numbers. However, demand remains high compared to pre-pandemic years in both markets. Central business districts are still seeing declines while suburban markets are maintaining strong demand.

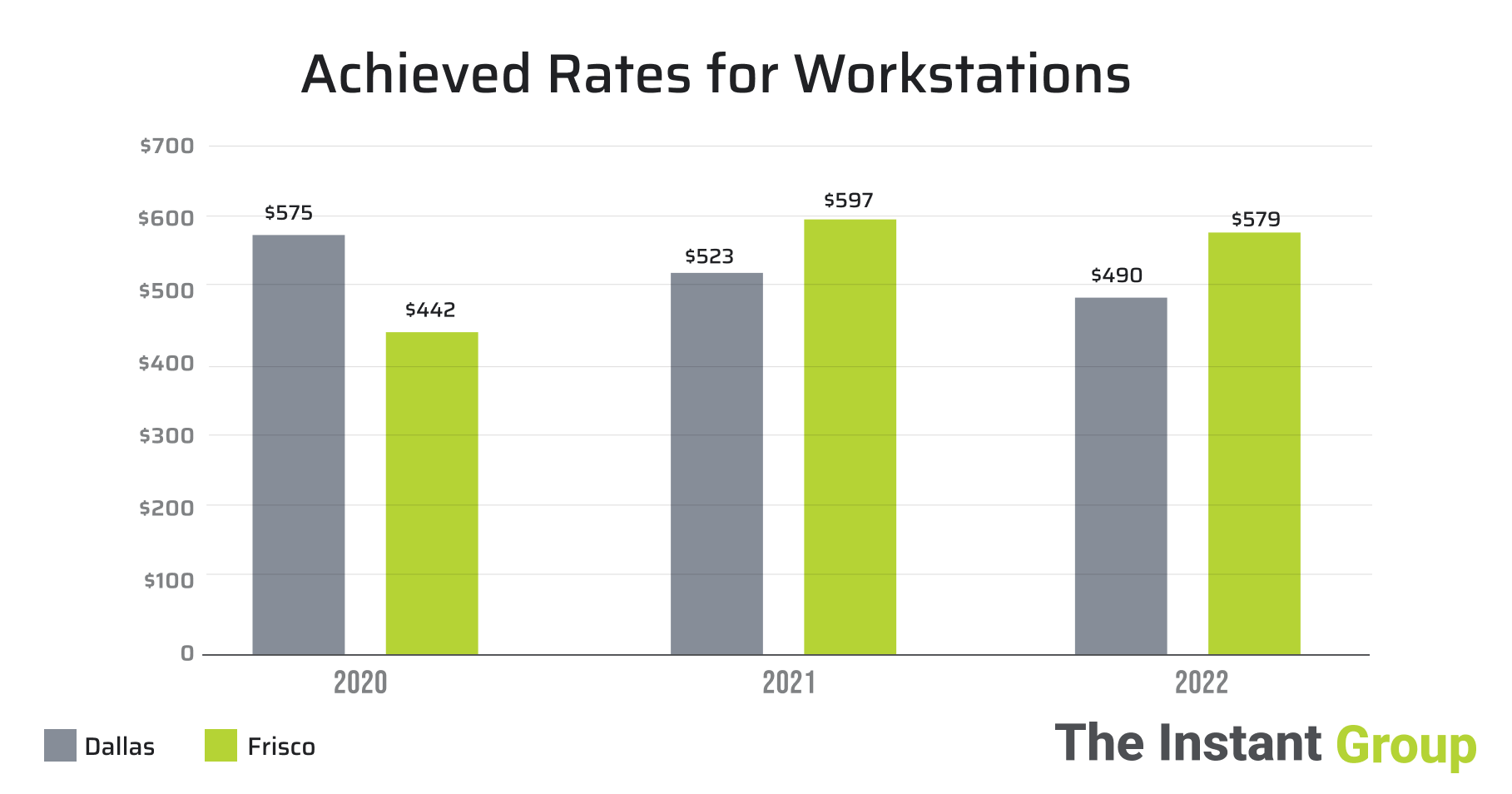

According to research by global workspace innovation firm The Instant Group, the average cost-per-desk for flexible offices in Dallas decreased by 6% from $523 to $490 between 2021-22.

Demand in the Dallas market, however, grew by 3% when compared to pre-pandemic demand in 2019. Still, demand in 2022 is well below the demand seen in 2021, which was 23% greater throughout the Dallas market.

In Frisco, the average cost-per-desk decreased by 3% from $597 in 2021 to $579 in 2022. Since the onset of the pandemic, workstation rates have increased significantly in Frisco, growing by 31% since 2020 from $442 to $579.

Demand in Frisco has also increased significantly compared to Dallas’ market — up by 75% compared to pre-pandemic, or 2019, numbers. However, demand in 2022 is still forecast to be 24% less than in 2021.

In terms of supply, or the number of flexible offices available, both cities have remained stable between 2021-22, with Dallas growing its supply by a mere 1% and Frisco showing no growth during this period.

“While rates and overall demand for flexible offices in Dallas and Frisco are down compared to 2021, we expect both to increase over the next year as inflationary pressures mount and more businesses seek a hybrid portfolio solution for their teams,” said Emily Watkins, Chief Client Officer, Americas, The Instant Group.

Interestingly, many of the largest cities in Texas have been leading the nation in current return-to-office figures, with Houston’s market seeing a 10 percentage point rise after Labor Day to 63% after being stalled at about 50% for five months.

With rising energy costs and inflation impacting workforce strategies, these market trends in Dallas and Frisco give evidence that companies are indeed taking a hybrid approach to their operations in the second half of 2022.

Methodology: The included data is compiled via The Instant Group’s leading flexible workspace data platform, Instant Insight. Rate data is based on transacted rates, providing the most accurate view available within the industry, while demand data is based on demand coming through The Instant Group’s digital booking platform, Instant Offices.